Modified agi limit for traditional ira contributions increased. Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.

Modified agi limit for traditional ira contributions increased. For 2025, the total contributions you can make to any ira (traditional or roth) can’t be more than the following limits:

Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older).

401k 2025 Contribution Limit Irs Over 50 Moira Lilllie, If you're age 50 and older, you can. Below are the 2025 irs limits and additional information to keep you informed.

401k 2025 Contribution Limit Chart, The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're younger than age 50. The maximum total annual contribution for all your iras combined is:

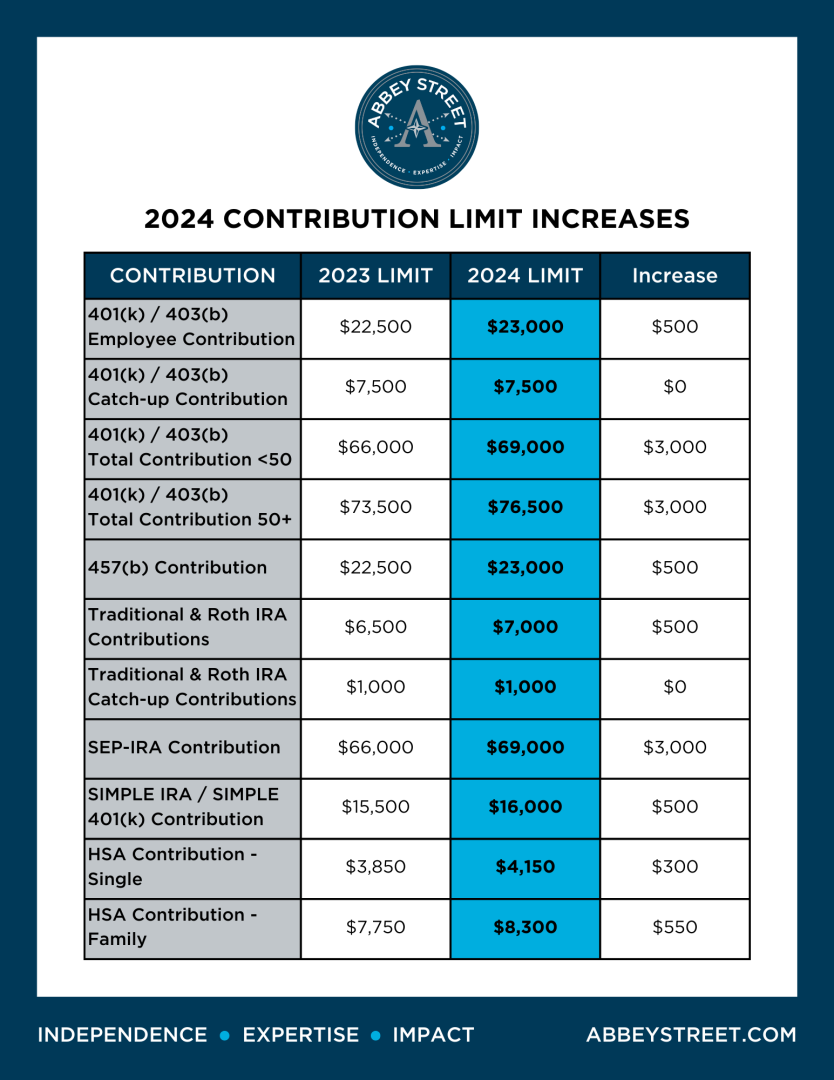

2025 Plan Contribution Limits Announced by IRS Abbeystreet, Key details on employee contribution changes and. If you're age 50 and older, you can.

Ira Limits For 2025 Abbey, Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up. The irs has set a maximum 401 (k) contribution limits up to $23,000 in 2025 which was $22,500 in 2025.

Simple Irs Contribution Limits 2025 Dore Nancey, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. The total overall 401 (k) contribution limit for 2025, which includes employer matching contributions and nonelective contributions, is $69,000.

401k 2025 Max Contribution Limit Irs Noell Charline, How might this impact your. The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're younger than age 50.

2025 Ira Contribution Limits Irs Marji Shannah, The maximum total annual contribution for all your iras combined is: If you're age 50 and older, you can.

IRS Announces 2025 Contribution Limits for Health Care FSAs Burnham, 2025 traditional and roth ira contribution limits. The irs has announced the 2025 contribution limits for retirement savings accounts, including contribution limits for 401(k), 403(b), and 457(b) plans, as well as income limits.

Roth 401k 2025 Contribution Limit Irs Sybil Euphemia, For 2025, the total contributions you can make to any ira (traditional or roth) can’t be more than the following limits: The irs released new limits for retirement contributions for 2025.

403b 2025 Contribution Limit Chart 2025 Dulci Glennie, Below are the 2025 irs limits and additional information to keep you informed. On the other side, if an employee is permitted by 401 (k),.

The irs has announced the 2025 contribution limits for retirement savings accounts, including contribution limits for 401(k), 403(b), and 457(b) plans, as well as income limits.

Contribution limits for 401(k)s, 403(b)s, most 457 plans, thrift savings plans (tsps), and other qualified retirement plans rise were $23,000 for 2025, rising from.